Always asked How Much Social Security Will I Get If I Make $25,000 A Year? The answer is yes. It’s a query frequently for those over 40 attempting to plan their financial future. Examining the variables that affect your Social Security income in more detail can provide you with essential advice on reaching financial independence.

First and foremost, it’s critical to comprehend that your lifetime earnings—more precisely, your most incredible 35 years of payments—are the basis for calculating Social Security benefits. Knowing 25 000 a year is how much a month, annual salary would affect your gifts will help you set reasonable expectations. Remember that there are more factors to consider, like the age at which you choose to begin receiving benefits, inflation, and modifications to the Social Security system itself.

How Much Social Security Will I Get If I Make $25,000 A Year

Let’s know How much social security will i get if i make $25 000 a year:

The monthly benefit amount is 1,886 for those who make 25,000 dollars a year instead of the previously stated figure since 1,880 dollars of benefits would need to be withheld.

Some important factors to know: How much social security will i get if i make $25000 a year?

Earnings History

Your $25,000 annual income from your business will be included in your earnings history. If you have made a constant salary of $25,000 for 35 years, Social Security will be considered your highest earning for 35 years; therefore, this income will be included in your AIME computation.

Full Retirement Age (FRA)

Whether you receive your total benefit amount or a lower amount will depend on your FRA. As was previously indicated, the FRA changes based on the year of your birth. Your benefit amount will be lowered if you begin receiving benefits before your FRA. Your benefit amount will grow if you continue to get help after your FRA.

Primary Insurance Amount (PIA)

Your PIA primarily determines your monthly benefit amount. Although the PIA calculation is complicated and prone to change, its goal is to give lower-income people a more significant replacement rate. Different elements are applied to other parts of your AIME by the PIA formula, which creates a progressive benefit structure.

Cost-of-Living Adjustments (COLAs)

Cost-of-living adjustments (COLAs) are made to Social Security benefits each year to assist them in staying up with inflation. Over time, these changes may increase your monthly use.

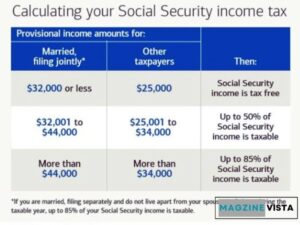

Other Income

Your Social Security benefits may be taxable if you have additional retirement income sources, such as a pension or investment income. If your total income exceeds specific criteria, some or all of your benefits may be liable to income tax.

An Example Calculation

Let’s look at an example to show how your 25 000 a good salary annual might be translated into Social Security payments. Please be aware that specific situations may differ, and this is an oversimplified example.

Let’s say you have been earning 25000 a month for life on average for 35 years, and your FRA is 67. After accounting for inflation, your AIME may be approximately $25,000. Assume that your PIA at your FRA is $1,500 a month. You would get $1,500 monthly if you filed for benefits at your FRA.

On the other hand, your benefit amount would be lowered if you start collecting benefits sooner, say at age 62. If your FRA is 67, the reduction is approximately 30%. Your gain in this scenario is roughly $1,050 per month.

Remember that the actual computation considers some factors, such as COLAs, additional income, and modifications to Social Security legislation, and that this is a simplified example. Using the SSA’s online resources or speaking with a financial counselor is crucial if you want an accurate estimate based on your unique situation.

What is Social Security in the USA?

In the United States, Social Security is a federal insurance program that offers retired people, people with disabilities, and surviving employees cash support. The Social Security Administration (SSA) is in charge of running the program, which is intended to assist you in maintaining a respectable level of life in retirement by replacing a portion of your pre-retirement income.

Payroll taxes, which are gathered from both employers and employees, are used to finance Social Security benefits. The Social Security Trust Fund, which distributes payments to qualified recipients, receives these taxes.

How Is Social Security Calculated?

The Social Security Administration performs intricate computations to compute your monthly benefits. Their core is an average monthly income from your top earning years, adjusted for inflation.

Your base monthly Social Security payment rate in retirement is calculated by running this monthly average through an income replacement calculation. Then, based on some variables, including your age when you begin receiving Social Security benefits, your job status in retirement, your tax bracket, and your Medicare premiums, this base rate will be changed either upward or downward.

Don’t worry if that sounds too complicated. This is the breakdown of each component used in the Social Security computation.

How Your Primary Insurance Amount Is Calculated

You can compute your primary insurance amount (PIA), which is the starting point for your Social Security benefits after you receive your AIME. The “bend points” that indicate how much of your income will be replaced by Social Security benefits in retirement are the basis for the PIA calculation.

Bend points determine a portion of your benefits depending on increasing earnings buckets; consider them tax brackets on steroids. Three buckets represent the bend points: 90%, 32%, and 15% of income replacement.

Jim Blankenship, certified financial planner (CFP) and author of “A Social Security Owner’s Manual,” claims that these bent point buckets assist in providing higher lifetime earners with a lower rate of income replacement and lower lifetime earners with a more significant proportion of income replacement.

Social Security Income

Social Security is calculated on a sliding scale based on your income, length of service, and retirement age. Annual increases in the Consumer Price Index are the basis for the automatic increases in Social Security benefits. Your Social Security benefits are increased by 1.5 times when you include your spouse. Please be aware that the calculator is based on the assumption that each spouse works alone. If your spouse worked and received a benefit greater than half of yours, your benefits can differ. You should perform the calculation twice, once for each spouse and their income, if you are a married pair and both of your partners work. Your benefits are solely estimated by this calculator.

The 2017 FICA income limit of $127,200 is used in the computations, and the maximum Social Security payment for an individual is $32,244 ($2,687 per month) per year, and for a married couple, it is 1.5 times. It would be necessary to earn the maximum FICA pay for almost your whole career to receive the maximum benefit. Additionally, you would have to start getting gifts at your full retirement age, which is either 66 or 67, depending on when you were born. This calculator rounds your Social Security benefit eligibility age to the next whole year. Your actual Social Security full retirement age, if you were born between 1955 and 1959, is 66 plus two months for each year that follows 1954. Your actual payout may vary based on your employment history and the complete set of Social Security compensation criteria.

Conclusion

In this article we describe How Much Social Security Will I Get If I Make $25,000 A Year? Regarding guaranteeing financial stability in retirement, Social Security benefits are essential. Your benefits calculation can be based on an annual income of $25,000. Still, the actual amount you receive will be determined by your entire earnings history, FRA, PIA, COLAs, and other sources of income. The question is 25 000 a year a good salary. Yes, to live a happy life this amount is good. To optimize your Social Security benefits and provide a happy retirement, thorough planning for retirement necessitates taking into account each of these aspects.

FAQs

How much Social Security will I get with a $20000 income?

People who make $20,000 a year pay that amount, which is 6.2% of their income or $1,240 yearly.

If you earn $30000 a year, how much will Social Security pay you?

If you make $30,000 a year, you must pay payroll taxes on all of it. That’s 6.2% of your salary, or $1,860 a year.

How much will your Social Security check be if you make $ 50,000 a year?

If you make $50,000 a year, you have to pay $3,100, or 6.2% of your salary, to Social Security.

What is the new income limit for Social Security in 2023?

The most you can earn and still get Social Security in 2023 is $21,240 annually.

At full retirement age, the maximum Social Security benefit in 2023 will be $3,627.