Newtek Small Business Finance is one of the best places to get loans and other financial help for small businesses. Newtek Lending is a company that works with the Small Business Administration (SBA) 7(a) loan program to help small businesses get the money they need to start up or grow. We describe complete Newtek Lending reviews.

Since its start in 1999, Newtek has helped small companies all over the United States with their money problems. The company wants small businesses to grow and be successful, so it gives them a range of loan options to fit their needs.

One of the best things about working with Newtek is that they are experts at SBA loans. The SBA 7(a) loan program can be hard to understand, but Newtek knows how to help businesses get the money they need by walking them through the steps.

What is Newtek?

Newtek is a tech company that wants to help businesses do well. The slogan for their business is “Your Business Solutions Company.”

Insurance, HR management tools, web services, IT services, and payment processing are just some of the business goods that the company sells. We’re going to talk about their Newtek Small Business Finance llc services today.

Newtek helps business owners and other lenders get the money they need for small businesses. Their lending goods are open to small businesses. Lenders and financial institutions can work with Newtek to get SBA loans done or tell their customers about Newtek.

Newtek began in 1998, went public in 2000, and now has assets worth more than $1 billion. They work with businesses in all 50 states and offer term loans and lines of credit.

Newtek Small Business Finance Overview

As a member of the Newtek Small Business Finance service providers, Newtek is a lending company. Small business loans and credit lines are among the lending alternatives offered by Newtek. Funding can range from $1,000 to $15 million, with five to 25-year repayment terms.

Newtek works with borrowers to create a tailored borrowing plan for each business by matching them with a specialized loan specialist. Representatives from Newtek may evaluate your company’s needs and provide the best financing choices, such as lines of credit, loans, and blended solutions that address your immediate and long-term Newtek SBA loan requirements.

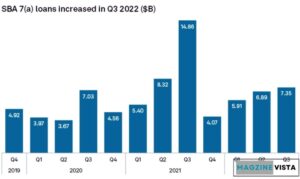

Newtek has earned a spot on our Merchant Maverick list of the top 10 SBA lenders. Newtek is a favored SBA lender and the third most active SBA 7(a) lender.

Newtek Small Business Finance at a glance

Newtek Business Loans Details

Term Loans

Term loans up to $15 million with 25-year durations are available from Newtek Small Business Finance.

How to Get a Business Loan from Newtek

Applications for Newtek Small Business Finance are either accepted or rejected based on several criteria. Every lender has different underwriting standards, but generally speaking, these consist of details from the applicant’s credit report and additional elements that show the applicant can repay the loan, such as earnings from the business. While fulfilling the standards listed below won’t ensure approval, doing so may help you determine whether a Newtek SBA loans is the best option.

Credit Score

No minimum credit score is disclosed by Newtek SBA for either personal or commercial use to be eligible for a loan or credit line. We advise aiming for a personal FICO score of at least 670 to qualify for the best rates offered by any lender.

Time in Business

Newtek Small Business Finance wants you to have a business that makes money and tax records from the last two to three years. You should get a starting business loan if your company has been open for over two years.

Annual Revenue

Newtek doesn’t say how much money your business must make each year, but it does say that it must be enough to pay back the loan. Lenders usually want to see something between $100,000 and $250,000 annually.

How to Apply Newtek Small Business Finance

You can start the application process by calling them or filling out a prequalification form for Newtek Small Business Finance:

Step 1: Apply

Applying for Newtek products is possible via United Capital Source. We need some essential company information on our one-page application. One of our account executives will get in touch with you after you apply to talk about your needs and assess whether Newtek SBA is a good fit for your company.

To finish the Newtek application, you should submit more information. Prepare to give business owners’ social security numbers, income statements, and business tax returns covering the previous two to three years. Newtek uses SSNs to do a credit check.

Step 2: Consult with Your Newtek Lending Expert

Once you submit the prequalification information, a Newtek Small Business Finance specialist will contact you. The rest of the application is completed by the specialist on your behalf. Results regarding prequalification are typically available within two business days.

Step 3: Require more paperwork and complete the loan

Your account specialist assists you in meeting any remaining Newtek Loan requirements after you have been pre-qualified. You may require more information, mainly if you are asking for an SBA loan. Completing this step of the loan application procedure may take several weeks.

Step 4: Receive Your Funds

You can get the money once the application process ends and you’ve been cleared. Most of the time, money is sent instantly to your business bank account.

Customer Reviews

Newtek Small Business Finance has received 4.4 out of 5 stars based on 11 reviews, the majority of which are positive. Customers who were happy with Newtek’s customer service reported that the staff was courteous and effective, and provided answers to all of their inquiries. However, a few dissatisfied clients brought up lengthy application procedures and little communication.

With varying reviews on Trustpilot, Newtek has a Better Business Bureau (BBB) rating of 3.49 out of 5. While a few customers praised the professionalism and helpfulness of the Newtek personnel, other Newtek SBA loans reviews expressed dissatisfaction over a loan application that was denied without providing a clear explanation.

Conclusion

A range of loan options are available from Newtek for different types of small enterprises. We discovered a plethora of favorable user evaluations to counterbalance the unfavorable ones left by others regarding this small business lender. There has been a noticeable improvement in user ratings since our last Newtek SBA loan reviews.

After carefully examining Newtek small business finance, llc, the only issue we found was a complete lack of clarity regarding rates and some opacity surrounding conditions. Remember that other lenders have earned our ire in this regard besides Newtek.

Fortunately, after you prequalify for Newtek finance, you can expect to receive complete disclosures. If you’re interested in finding out more about a loan from Newtek, you can contact them by phone or online to learn more about their offerings, possible fees for their financial products, and borrower requirements. This will help you decide if this lender is the best fit for your small business.

However, if you prefer to continue searching for a lender who is a better fit for you, we can recommend some. See our list of the top business credit lines for information on credit lines. Don’t worry if your credit could improve; we still have solutions. For instance, you can apply for a Newtek loans where a credit check is not necessary.

FAQs

Is Newtek a preferred SBA lender?

One of the few online lenders that the SBA recommends is NewtekOne, which used to be called Newtek.

How do I qualify for a Newtek business loan?

You can qualify for Newtek business lending, If you fulfill these requirements:

-

As in business for at least two to three years.

-

Business tax records from the last two to three years.

-

To be a business in the US that makes money.

-

Having enough cash flow and earnings to pay back loans.

Is Newtek bank reviews good?

Yes, Newtek is a genuine advice loan that helps small businesses get the money they need and the best solutions.

What is the most accessible SBA loan to get?

It’s possible to get an SBA Express loan in two or three days. The loan terms are also excellent because the SBA guarantees 50% of the loan amount.

Is Newtek legit?

Newtek is a real small business lender.